TRADER TAX STATUS

SECTION 475(F) MARK-TO-MARKET ACCOUNTING AND IRS FORM 4797

TRADER TAX STATUS

SECTION 475(F) MARK-TO-MARKET ACCOUNTING AND IRS FORM 4797

Is Trader Tax Status for you? There is a lot of confusion about “Trader Tax Status” and “Mark-to-Market”. In this guide, learn what’s involved in the Section 475f election and mark-to-market accounting method. Understand how to report Form 4797 for gains/losses.

CONTENTS

WHAT IS MARK-TO-MARKET ACCOUNTING?

Mark to market (MTM) is an accounting method where the price or value of a security reflects its current market value. Applied to taxes from trading it means each security held open at year end is treated as if it were sold at fair market value (FMV) on the last business day of the tax year.

The net result is that you realize a taxable gain or loss on your holdings for that particular tax year, even though your position is still open. Normally, you would not realize a taxable gain or loss until you closed your position in a security. The year end closing price is then used to establish the cost basis of your holdings going into next tax year.

There are certain securities that by definition get marked to market at year end for tax purposes. These are considered IRC Section 1256 contracts by the IRS and include:

- Regulated futures contracts

- Non-equity options such as on bonds, commodities, and currencies

- Exchange traded index options (ETF/ETN options)

All other securities normally use the cash basis method of accounting where you do not realize a gain or loss for tax purposes until the year that you closed your position in that security.

SECTION 475(F) ELECTION TO USE MARK-TO-MARKET ACCOUNTING

Beginning in 1997 the IRS permits active traders, who qualify for “trader tax status” and operate as a trading business, to elect the mark to market accounting method.

A trader in securities or commodities may elect under section 475(f) to use the mark-to-market method to account for securities or commodities held in connection with a trading business. Under this method of accounting, any security or commodity held at the end of the tax year is treated as sold (and re-acquired) at its fair market value (FMV) on the last business day of that year.

What this basically means is that all open positions at year end are “marked to market” or priced to year end market prices to close out the position on paper. Your open positions are still open, but now the year end prices become the cost basis of your open positions going into next tax year.

WHAT ARE THE PROS AND CONS OF ELECTING MTM?

PROS: Simplified Tax Reporting / May Reduce Taxes.

Many active traders find this election appealing as a way to make filing simpler — and possibly reduce their taxes. However, there are qualifications and an election process that must be followed. Please see the How To Elect MTM topic below for details.

There are two major advantages of electing MTM:

- Since all positions are marked to market (priced to year end market prices) at year end, there are no wash sales to calculate or report to the IRS.

- If you happen to have a loss from trading greater than $3,000, you can deduct this loss from any other income, and possibly ammend a previous year’s tax return and get a refund.

If you are an active trader in securities or commodities with a mark-to-market election in effect for the current tax year, then the following benefits can be yours:

- Gains and losses from all securities or commodities held in connection with your trading business are treated as ordinary income and losses, instead of capital gains and losses.Normally, if your capital losses exceed your capital gains, the amount of the excess loss that can be claimed is limited by the IRS to $3,000 (or $1,500 if you are married filing separately). If your net capital loss is more than this limit, you can carry the loss forward to later years. Now imagine a year where you lost $100,000! How many years would it take to recoup that at a rate of $3,000 per year?With MTM status the limitations on capital losses do not apply. Therefore, if you had a substantial loss, you may deduct this loss against all other types of taxable income without the normal $3,000 loss limitation.

- Mark to Market accounting provides a type of “tax loss insurance” as losses can be carried back two tax years. This is great news for active traders, who may have made a killing for one or more years only to have a substantial loss the following year. If you have no other income to offset this large loss, you may amend the previous two year’s tax returns and get a refund! No one likes to lose money, but knowing you have some recourse to recoup some of those losses in case you do is quite comforting.

- The wash sale rule does not apply to securities or commodities held in connection with your trading business when you have MTM trading status. This is also great news for active traders and may save quite a bit of heartache come tax time – see our Wash Sales: How they affect me trader tax topic.

CONS: Mark to Market accounting is not without some downsides.

For example, if you have a large unrealized gain at year end in one or more of your open positions, you are forced to close those positions (on paper) using the year end prices which increases your current year taxable gain. This is true whether you are long or short. Normally you do not realize gains until you actually close your positions, so be aware of this at year end if you have elected MTM.

You also must qualify for, and then make a proper timely election with the IRS enabling you to use the MTM accounting method.

HOW TO MAKE THE MARK-TO-MARKET ELECTION WITH THE IRS

To make the mark-to-market election for 2024, you must have filed an election statement no later than the due date for your 2023 return (without regard to extensions). The statement must be attached to that return or with a properly filed request for extension of time to file that 2023 return (Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return). The statement must have included the following information.

- That you are making an election under section 475(f)(1) or (f)(2) of the Internal Revenue Code.

- The first tax year for which the election is effective.

- The trade or business for which you are making the election.

If you are a new taxpayer and not required to file a 2023 income tax return, you make the election for 2023 by placing the above statement in your books and records no later than March 15, 2024. Attach a copy of the statement to your 2024 return.

IMPORTANT: Do not file Form 3115 at the same time you make your MTM election, as it may cause you to lose your MTM status!

After making the election to change to the mark-to-market method of accounting, you must change your method of accounting for securities when you file your taxes for the first year using MTM accounting. You do this by filing Form 3115 – Application for Change in Accounting Method.

Form 3115 is filed the first year you file as MTM, for example: if 2024 will be your first year MTM, you would send the statement of election with your 2023 return, and Form 3115 would be filed with your 2024 tax return.

Form 3115 is also where you attach your section 481 adjustment – see How to Report Gains and Losses on IRS Form 4797.

Once you make the election, it will apply to the current tax year and all later tax years, unless you get permission from the IRS to revoke it.

MTM Election Deadline: Unless you are a new taxpayer, the election must be made by the due date (not including extensions) of the tax return for the year prior to the year for which the election becomes effective. If you have not made the MTM election by April 15 of the current tax year, then you will typically have to wait till next year to do so. Some exceptions may apply, please consult with a trader tax professional about your situation.

- To elect Section 475f MTM for 2023 tax year, the election must have been filed by April 18, 2023.

- To elect Section 475f MTM for 2024 tax year, the election must be filed by April 15, 2024.

For more details on the mark-to-market election and reporting see: IRS Publication 550 page 103, Special Rules for Traders in Securities or Commodities.

Also see: Revenue Procedure 99-17 on page 52 of Internal Revenue Bulletin 1999-7.

HOW TO REPORT GAINS AND LOSSES ON IRS FORM 4797

If you properly made the mark-to-market election with the IRS, you should report all gains and losses from trading as ordinary gains and losses on Part II of Form 4797, instead of as capital gains and losses on Schedule D. In that case, securities held at the end of the year in your business as a trader are marked to market by treating them as if they were sold (and re-acquired) for fair market value on the last business day of the year.

- Do not mark to market any securities you held for investment. Report sales from investments on Schedule D, not Form 4797.

- Those who have elected the Mark to Market accounting method with the IRS report their gains and losses on the IRS FORM 4797 – Sales of Business Property – line 10.

Securities or Commodities Held by a Trader Who Made a Mark-To-Market Election

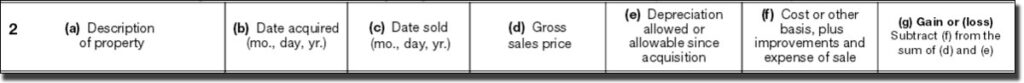

Report on line 10 all gains and losses from sales and dispositions of securities or commodities held in connection with your trading business, including gains and losses from marking to market securities and commodities held at the end of the tax year (see Traders Who Made a Mark-To-Market Election, earlier). Attach to your tax return a statement, using the same format as line 10, showing the details of each transaction. Separately show and identify securities or commodities held and marked to market at the end of the year. On line 10, enter “Trader—see attached” in column (a) and the totals from the statement in columns (d), (f), and (g). Also, see the instructions for line 1, earlier.

Key steps explained:

- Attach to your tax return a statement, using the same format as line 10, showing the details of each transaction (such as the TradeLog Form 4797 Attachment report).

- On line 10 of Form 4797 enter “Trader – see attached” in column (a) and enter the totals from the Form 4797 Attachment report in columns (d), (f), and (g).

- Separately, show and identify securities or commodities held and marked to market at the end of the year (you can use the TradeLog Securities Marked to Market report for this).

- If this is the first year using mark-to-market accounting: you will need to attach a detail of transactions for Section 481 adjustment along with your Form 3115 – see Form 3115 instructions. You can use the TradeLog Section 481 Adjustment report for this attachment.

Since all trades are priced to year end market prices and are therefore held one year or less, all of the MTM trades are by definition short term and are considered ordinary and are to be listed in Part II of this form.

There are seven columns in Part II as shown below:

Column (e) Depreciation is not used for the purposes of investments, only columns a-d and f-g.

All of the same trade matching rules involved in reporting trade history for capital gains and losses apply for MTM, so having an automated method of doing so can save you many hours of work.

WHY YOU NEED TRADELOG IF YOU ELECTED SECTION 475f TRADER TAX STATUS

TradeLog was designed to meet the tax needs of active traders in securities who have elected or are about to elect Trader Tax Status and the mark to market (MTM) accounting method. In addition to automating the process of importing your trades from your online broker and matching them properly for Form 4797 reporting, TradeLog provides the necessary mark to market accounting procedures and reports which greatly simplifies the filing of your trader tax return. Learn more and get started using TradeLog for free.